Myconstant - P2P lending app for iPhone and iPad

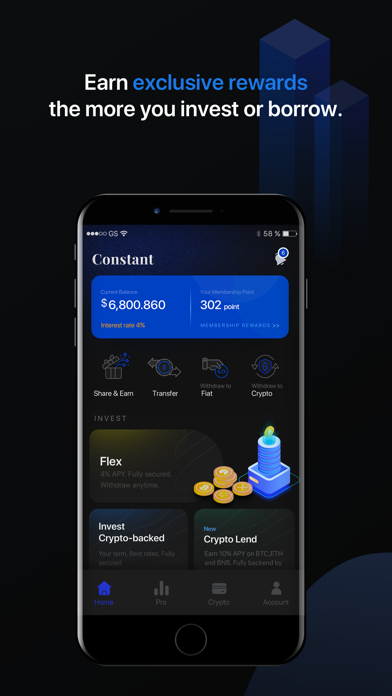

Constant: a world of financial power in your pocket.

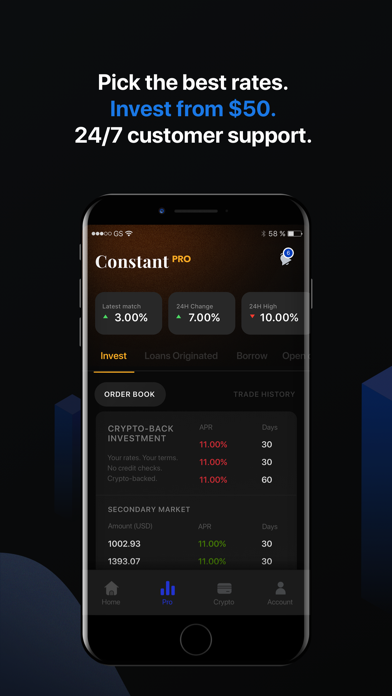

You choose the interest rate. You choose the term. We match you with someone happy to do business with you.

Investors: enjoy up to 8% APR on your money, with terms of any size starting from 30 days. All lending is 150% backed by liquid collateral that’s easily sold if borrowers default, protecting your investment. Auto-reinvest your earnings or withdraw in USD or stablecoins.

Borrowers: borrow against 60+ cryptocurrencies at flexible rates and terms. BitGo insured custody and smart contracts protect your assets until you repay. Top up collateral if it falls in value or withdraw excess if it increases. Get cash for crypto without selling up.

Constant gives you more:

Free withdrawals.

Invest or borrow from just $50.

Earn up to 4% APY on your balance through Flex.

24/7 customer support on email, phone, and social media.

How it works

Borrowers:

Choose an amount, interest rate, and term.

Select your collateral.

Send your collateral to BitGo or smart contract.

Withdraw your loan in USD or supported stablecoins.

Repay (in USD or crypto) and your collateral is returned.

Investors:

Choose an amount, interest rate, and term.

Transfer your funds (USD or stablecoins).

Match with a borrower.

Start earning interest immediately.

Withdraw your principal plus profit at the end of the term.

Flex: investing made easy

Fixed term investing not your thing? No worries – just deposit funds and your balance automatically earns up to 4% APY (variable) through Flex, a fully secured lending pool. You can withdraw anytime for free, and your balance is protected by borrower collateral.

You can also disable Flex from Settings, and instead your balance will be escrowed with Prime Trust, an accredited US custodian insured to $130M.

What are customers saying about Constant?

“Great solution, was really awesome to be able to borrow against my Wanchain! Lots of great features on the site, the staff on telegram have been very helpful in guiding me and providing me usability tips.”

Jason M

“My experience with Constant has been nothing but positive. Awesome opportunity to escape the volatility of the stock market while making your money work for you. Incredible and responsive customer service answers any and all questions quickly and efficiently.”

Kasey C

“I have been using Constant for the past few months, and their customer service is always helpful. Any issues they will always respond fast! I plan on using them for a long time to come.”

Karek

Terms and conditions

Maximum loan term is 18 months.

Minimum loan term is 30 days.

The maximum Annual Percentage Rate (APR) is 12%.

You can repay at any time during the loan term.

Your maximum repayment period is the duration of the loan.

You’re not required to make minimum or regular payments. Simply repay the total repayment amount by the end of your term.

If you’re more than 3 days late in repaying your loan, your collateral will be sold to repay your investor.

Borrowers will be charged a 1% matching fee on the value of their loan.

There are no investment fees for using the platform.

All cryptocurrency and fiat withdrawals are free.

Please read our Investor Agreement and Borrower Agreement before using the platform.

Loan example: If you request a loan of $1,000 at 8% APR, you must put up $1,500 worth of your chosen cryptocurrency as collateral. Once your loan term ends, you will need to repay a total of $1,080 to get your cryptocurrency back. If you fail to repay within 3 days of your loan maturity date, or if your collateral’s value falls to 110% of the investor’s principal plus earned interest at any point during the term, your collateral will be sold to repay the investor and you will receive the difference in USD (if any).